Oct 31 2019 Shibuya (TSE: 6340) Jeffrey Au

Brief Summary:

Market Cap ¥79-81B (USD735M)

Net sales ¥108B

(USD998M)

Total Debt ¥5.4B (USD50M)

Cash ¥30B (USD277M)

Enterprise Value 80 + 5 – 30 = ¥55B (USD508M)

EBIT = ¥10.3B (USD95M)

FCF = ¥6-7B (USD60M)

Earnings power = ¥8-11B (USD92M)

Tangible Book Value = ¥60B (USD554M)

Working Capital = Current Assets – Current Liabilities = 88

– 56 = ¥32B (USD295M)

Working Capital – Cash = -¥1B (USD -9M)

Net Property Plant & Equipment = Fixed Assets = ¥33.5B (USD

309M)

Packaging plants 56% (EBIT margin 15%)

Mechatronic Systems 29% (EBIT margin 5%)

Agricultural Facilities 15% (EBIT margin 7%)

Overseas sales ratio 27%

Capital Employed =

Debt + pensions + Fixed Assets + Working Capital - cash –

goodwill - intangibles

= 41B yen (USD378M)

Capital Returned (Owner’s earnings) = ¥11B (USD 101M)

ROIC = 26%

(ROIC for previous 4 years was 8-10%)

Investment Thesis

Shibuya holds 70% market share for Japanese aseptic

packaging for consumer goods – food & beverage, pharmaceuticals,

regenerative medicine, and cosmetics—as an integrated systems supplier. Through

customer Nipro, Shibuya also has a 20% domestic market share in dialysis

machines. Shibuya has a healthy quick ratio of 1.2x and a debt to equity of 8%.

Shibuya has 3 main divisions:

1.

Aseptic packing which makes up 65% of Shibuya’s sales

in 2019 with operating income of 9.87B yen.

2.

25% of sales in mechatronics (cutting &

grinding machines, medical equipment –dialysis & laser dermatology,

semiconductor equipment) with an operating income of 1.6B yen.

3.

10% of sales in agriculture (vegetable and fruit

sorting machinery) with an operating income of 1B yen.

After taking into account for unallocated adjustments, total

operating income was 10.3B yen (USD95M). The bulk (80-85%) of operating income

came from Aseptic packaging, while 13-15% EBIT came from mechatronics and 5-7%

EBIT from agricultural sorting equipment.

A third of Shibuya’s sales, mechatronics— has too many divisions

and lacks product focus. Shibuya’s management made a terrible decision to

acquire semiconductor equipment manufacturer Kaijo in 2012, resulting in poor

margins and an operating loss for more than a decade until 2016. The operating margins

of Shibuya’s packaging division are 9-10%; in contrast, the operating margins

of the Mechatronics division are 5%.

Mechatronics has too many subdivisions—cutting systems

including: laser-processing, water-jet, and hydrogen-gas; semi-conductor

soldering systems and mounters, medical equipment, laser surgery, dialysis

equipment, ultrasonic generators and hydraulic-press, etc. Mechatronics

received the most of 2019’s R&D budget with the highest capital

expenditures of all divisions— 2.7B out of a total 4.7B CapEx in 2019— whether

this translates into consistent cash flows with operating margins higher than

5% is yet to be seen. Trying to be everything to everyone leads to satisfying

no one.

The agricultural

equipment segment includes fruit and vegetable grading and sorting. Shibuya

should be cautious since this is not a stable segment— clients depend on

Japanese government grants for funding.

If I were in charge of Shibuya, I would cut out the agriculture

business and restructure the mechatronics division— I would spin off the

grinding/cutting machinery and semiconductor equipment and keep the dialysis business,

as they already have 20-25% market share in Japan. From the proceeds, I would

distribute dividends, or announce buybacks (highly unlikely for Japanese

management and Shibuya’s historical record).

Another alternative would be to increase international

sales, which currently makes up 25% of total sales. Previous international

projects include American customers such as Mott’s (manufactures juices), HP

Hood (dairy company), a Thai beverage company (beers and juices), etc.

Comps

Shibuya has a predictable business and is currently cheap

relative to its peers. There are more than 11,000 aseptic packaging systems in

operation supplied by more than 30 companies. However, only a few companies

have the size, experience, and capitalization to gain economies of scale.

Amcor specializes in flexible and rigid packaging for

consumer goods with a huge market-cap of 15B, while Italian company IMA (market-cap

2.7B) specializes in pharmaceuticals resulting in slightly higher gross margins

than Shibuya. Both have catastrophic risk from leverage (Amcor at 109% debt to

equity, IMA at 184%).

Krones AG, with a 2B market-cap has poor operating margins

3.8% due to a poor European market and required new financing to support its

equity base.

Italian company GIMA at USD 735M is the closest competitor

in terms of Shibuya’s market-cap (685M) and has ridiculous operating margins of

35% and an ROIC of over 30% due to their packaging for cigarette brands. Should

new regulations or competitors be introduced, GIMA’s earnings may be hampered.

Balance Sheet

Shibuya is incredibly cheap compared to its peers at a

market cap of USD735M. At 3-4x TEV/Ebit, it should be worth at least three

times market capitalization – USD 2.1B, to bring it to a level multiple similar

to its peers. Cash is about a third of capitalization at USD 276M with very

little debt (USD 50M). Shibuya’s debt to equity has decreased from 46% in 2014

to 8% in 2019 and completely eliminated short term debt.

Shibuya has significant advance payments of ¥10.4B (USD 96M)

in 2019 from undisclosed customers in the latest annual report which counts as current

liabilities; the previous year was only ¥4.1B. This skews working capital and

makes it seem like receivables are inadequate after deducting cash. Whether

advanced payments will remain the same size every year is yet to be seen. To be

conservative, Shibuya is at least worth USD1.7B.

Should Shibuya remove low margin operations (5%) in the

Mechatronics division and increase regenerative medicine sales, boost sales in

the packaging division, and ramp up dialysis sales, operating margins should go

up to 13-20%. Mechatronics had negative operating cash flow for a decade until

the last few years.

In this article, I will only elaborate on the strong

segments of Shibuya’s business—aseptic packaging for food & beverage, and

regenerative medicine; and dialysis—under mechatronics. Agriculture, and semiconductor

and grinding equipment under Mechatronics are poor segments which need to be

eliminated.

Aseptic Packaging –

Consumer Goods

Aseptic packaging for consumer goods contributes to the bulk

of Shibuya’s operating profit and 60% of sales. Shibuya is a systems integrator

for sterilized packaging—integrating all equipment operations—sterilizing/rinsing,

filling, capping, and labeling for glass bottles, cans, PET, and cartons. It is

safe to say Shibuya has a domestic monopoly— filling 70% of aseptic packaging for

Japanese food and beverage manufacturers. Shibuya now consists of 16

subsidiaries with a U.S partner, Hoppmann.

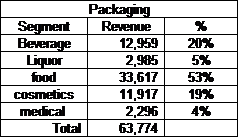

Beverage and liquor bottling (juices, soft drinks, dairy,

beer, sake, and spirits) accounts for 25% of Shibuya’s total packaging sales. Food

(seasoning, cooking oils, noodles) accounts for 53% of packaging sales.

Cosmetics vials, detergent packaging, and medical ampules accounts for 23% of

sales. Packaging systems include casers and un-casers, carton-machines,

multi-packers, pouch filling machines, etc.

Well-known clients include—

Drinks- Kagome, Sapporo, Asahi, Kirin, Mott’s, HP Hood, Thai

Beverage,

Hokuriku Coca Cola Bottling (Tonami Plant) – “Coke” branded products - Aquarius, Georgia Coffee

etc.

Regenerative Medicine – Helios, Promethera

Pharmaceuticals – Astella, Mochida

Global demand for aseptic packaging machinery is USD 40

billion and will reach USD 55 billion by 2025, growing 3-6% year. China, Indonesia,

Thailand, and Malaysia will grow faster than mature markets such as Western

Europe, Japan, and the U.S.

Food brands reduce their costs by switching from cold chain

logistics or preservatives & retort (lamination) methods, to sterilized

cartons, plastics, or cans. They pay Shibuya a high initial investment to

install packaging machinery customized to their processes, but will see a

return on investment in two to five years. Customization for packaging is based

on the customer’s budget and floor area.

Shibuya’s in-house proprietary technology keeps products

sterile without heat, so thinner plastic bottles can be used while filling

bottles with room-temperature liquids. Older systems cost more due to higher

energy consumption— ultra-high-temperature (UHT) to kill bacteria, retort

systems, preservatives which required chilling, etc. Shibuya acquired the

approval of the US Food and Drug Administration (FDA) for its overseas beverage

plant installations which is crucial, since 60% of Shibuya’s aseptic filling

systems are expected to be shipped overseas.

Shibuya’s rotary filler was the first FDA-accepted filler

for low-acid beverages validated in 2005—the packaging line at the Sacramento

plant is one of the fastest and most sophisticated low-acid aseptic

lines. Regarding sterilization, Shibuya also has a proprietary aseptic

Electron-Beam-Filling-System.

For foreign customers, components are built at the Kanazawa

facility, shipped abroad, and assembled on-site. There have been requests from Chinese

and Southeast Asian beverage manufacturers and rivals to share Shibuya’s systems

integrations technology by building components abroad. However, Shibuya would

rather produce domestically to retain quality— "if you think about

maintaining quality and cost, overseas production is actually very costly; we

compete on our technological ability, without licensing contracts,"

President Hirotoshi Shibuya said.

Shibuya dominates packaging with sterilization technology

since they require less equipment space without sacrificing utilization rate or

raising prices. In one of Shibuya’s projects, a Thai beverage maker requested

for lower prices which spurred Shibuya to cut costs by 30% on its main factory

in Kanazawa. "We will simplify the structure of not just filling

equipment, but also peripheral equipment such as liquid processing," said

President Hirotoshi Shibuya. Shibuya redesigned the mechanical parts of its

equipment and shrank the floor area by two-thirds; which was required to

install a unit which fills 600 bottles a minute, slashing the production cost

by 35%.

Aseptic Packaging –

Regenerative medicine

Shibuya’s packaging segment, which dominates the Japanese

market with proprietary sterilization technology, is expanding into

regenerative medicine for its incredible growth. Shibuya has launched

full-fledged production for aseptic cell culture by leveraging on previous

bottling technology gained from pharmaceuticals.

Regenerative medicine involves culturing large quantities of

cells for bone marrow therapies, and stem cell research. Cell processing centers

require a germ and contamination free operational environment which is

recreated inside an isolator.

The isolator completely separates the technician from the

process.

Shibuya started joint development with the Yamaguchi University on sterilized cell culturing for liver cirrhosis treatments, while receiving venture support from the Riken research institute. Cell processing isolators have also been joint developed since 2017 with Belgium Promethera Biosciences. Shibuya has an exclusive license for spinal cell administration therapy.

Sales related to regenerative medicine was approximately 500

million yen (USD 4.86 million) in 2014, but has impressively grown 29 fold to 15.6

billion yen (USD 144 million) in 2019, which exceeded the president’s original

goal of 10 billion yen within five years. Shibuya has built a new factory for

regenerative medicine equipment in an industrial park in the Kanazawa suburbs.

Mechatronics- a

cluttered, disappointing tumor

Shibuya’s mechatronics segment covers a broad range –medical,

semiconductor bonders and mounters, inspection equipment, and laser

applications. It suffers from a lack of management and focus. The mechatronics

segment existed since early 2000s, but sustained negative operating profits

until 2016. While the packaging segment has operating margins of 9-10%,

mechatronics in 2019 only has 5% operating margins.

Most of mechatronics divisions have a fixed cost burden with

poor utilization rates and lack of pricing power. Mechatronics system business

sales are expected to decline due to inventory adjustments for medical

equipment, while the number of cutting machines will increase slightly due to

an increase in new fiber laser machines. Semiconductor equipment sales have

fallen significantly due to the effect of US-China trade war – Shibuya focused

on manufacturing for optical communication parts compatible with 5G.

Mechatronics –

Dialysis

The only saving grace of the Mechatronics sector is the

dialysis segment. A dialysis device artificially purifies blood, removes waste,

and adjusts water levels by compensating for declined kidneys. Shibuya has developed

medical equipment with Nipro since 1987, utilizing liquid control technology developed

from beverage filling machines— accurately controlling the flow of dialysate

and blood. 3 million Dialysis treatments have been carried out in Japan, and may

increase to 3.7 million within a decade.

Dialysis makes up of 15% (15.6B) of Shibuya’s total sales

(108B). In Japan, two companies dominate dialysis treatment equipment with 70%

of the market— Nikkiso has 45-50%, and Shibuya has 20-25% as Nipro’s supplier.

The spread of medical insurance and the number of patients

with diabetes and chronic renal failure increases in proportion with emerging

countries where middle-income group rise—leads to the expansion of dialysis

treatment. Expensive dialysis treatments are expected to continue to grow at an

annual rate of 5-6%.

China, India, South America all have a huge demand for

dialysis equipment— In 2018, Shibuya expanded facilities to double production

capacity from the current 10,000 to 20,000 in Kanazawa City by investing approximately

2B yen. Capital expenditures include the dismantling of an old building and

equipment costs. The new factory was rebuilt in one of four production

buildings in Kanazawa with 4 floors and an area of about 8,000m2.

Competitor Nikkiso manufactures for Japanese and European

customers at its plant in Kanazawa. Nikkiso, with 50% domestic market share, has

bigger ambitions by completing a second production base with local production

in China through a joint venture with Wei-Gao Group in Shandong Province. They

aim to increase capacity by 5 times in less than a decade.

Capital Allocation-

CapEx, working capital, and change in equity

In the last five years (2014-2019), capital expenditures

were 22.2B (USD205M) –capital was allocated towards buying additional fixed

assets such as machinery and buildings to increase domestic production capacity,

particularly for packaging, and to replace depreciating tools and equipment.

In a five year time frame, 15.29B (USD146M), the bulk of

capex, was correctly spent on expanding the packaging segment; 5.2B (USD48M) of

capex were for mechatronics; with 1.69B (USD15M) for agriculture equipment.

In 2019, total capital expenditures were 4.7billion yen

(USD43M). 1.75B yen of capital expenditures in 2019 was for improving the

packaging business, particularly for the new Negami headquarters.

What worries me is that mechatronics had the highest capital

expenditures in 2019, since it was ramped up to 2.7B yen, with only an average

annual expenditure of 500M yen in previous years. Part of these expenditures

for mechatronics is a medical equipment factory at Wakamiya. While the capital

expenditures of medical products are said to be reverse osmosis related (RO

systems) in the annual report, hopefully it will be for dialysis equipment. If

this is true, we can expect a lot of growth and adequate return on investment.

As mentioned earlier, Shibuya has paid off all short term

debt, which resulted in an incremental increase of 13B yen (USD120M) in working

capital from 14.8B (USD 136M) in 2014 to 27.8B (USD256M) in 2019. Operating

cash flow doubled from 5.3B in 2014 to 10.9B in 2019.

Equity increased by 24B from 2014-2019. Equity was 38B in

2014 and grew to 62B in 2019. Equity increased due to an increase in fixed

assets (29B to 33B) and retained earnings (12B to 43.9B) and a decrease in long

term debt from 9.6B in 2014 to 3.68B in 2019. Equity grew at 8% per annum in a

5 year time frame.

Owner’s Earnings,

capital employed and ROIC

If we look at a five year time frame of 2014-2019, Shibuya

had a cumulative owner’s earnings of 25-35B, with 4.8B paid in dividends with

40.6B of debt issued.

Each year, about 10-15 billion yen of operating cash flow is

generated by Shibuya. To be conservative, we assume annual capital expenditures

of 4 billion, with 2 billion for maintenance, and 2 billion for growth

expenditures. 1 billion will be deducted for payment for long term debt

annually, and 2 billion will be paid out in the form of dividends. This leaves

3-5 billion per year for retained earnings.

Total Capital employed (equity, deferred obligations,

leases, debt, less goodwill) decreased by an increment of 10.8B from 2014(51.9B)

to 2019(41.9B). Of the 41.9B approximately 11B of owner’s earnings was produced,

producing an ROIC of 26%. 2019 may be an exceptional year and may not be

sustained, as capital employed in previous years was also around 40B, but owner’s

earnings returned was only near 3-5B, bringing ROIC to a lower 8-11%.

Approximately 25-35B of owners earnings were produced in 5 years.

Going forward, I do not expect capital employed to decrease, but expect it to

increase slightly due to additional fixed assets and level off— Shibuya’s

president has mentioned his commitment to keeping factories domestic.

Risks-

With Shibuya’s cash reserves amounting to a third of market

capitalization and low amount of leverage, Shibuya risk does not come from its

balance sheet, but rather from its ability to execute and allocate capital.

Management will most likely continue what they have done before— issue higher

dividends and not entertain buybacks or cut off poor segments in its business.

Customer concentration is not a risk, as the only customer

who exceeds 10% of revenues is Nipro at 15%, which Shibuya partners with for

dialysis machines.

Shibuya has monopolized local food and beverage brands which

serve as a healthy base to rely on. They should not be complacent and seek

customers in to south-east Asia. Management also hopes to expand sales channels

in the United States and other countries and increase sales of medical

equipment by 70% in 5 years.

One concern is keeping utilization rates or capacity over

80%. There is a lack of technical laborers in Japan— most engaged in production

for Shibuya are mainly temporary workers. A robotic assembly fleet is being

introduced by Shibuya in response to labor shortages.

Additional data I would have liked to include in this report

but could not obtain include– average sales price for different equipment, the

number of contracts and equipment sold, terms and duration of contracts,

breakdown of cost of goods sold, and the utilization rates of individual

factories.

The demand for aseptic packaging for consumer goods should

be steady unless regulation tightens or a recession occurs. A changing regulatory

environment, a weak mechatronics division, disruptions in technology, and

volatile raw material prices, and foolish acquisitions are all threats to

shareholders.

Pricing power for Shibuya’s should not decrease in the near

future, as brand owners view Shibuya’s service as value added. In the same

token, pricing power is stronger domestically due to connections in Japan but

weaker abroad despite Shibuya’s proprietary technology and FDA approvals as

there are more competitors globally. While Shibuya may not be able to command

the highest prices, quality components and experience in design gives them a

competitive advantage and secures a reasonable price and deposits for advanced

payments.

Catalyst and

Valuation

Owner’s earnings are currently USD110M, which can

potentially double in 3-5 years to 200M. Assuming an owner’s earnings of

150-170M and multiplying by 10, we have a market capitalization of USD

1.5-1.7B. As mentioned before, Shibuya is trading at 3-4x EV/EBIT, while peers

are trading at 11-12x EV/EBIT.

Even if the 25% of the business with poor operating margins is

not eliminated— mechatronics (5%) and agriculture (7%), the bulk of operating

profit comes from aseptic packaging at 85%. The market should eventually

realize the value of Shibuya’s domestic earning power in aseptic packaging, and

with elimination of short term debt and decreasing long term debt with

increased dividends, there should be greater shareholder value despite the

hesitance for share buybacks.

If management doesn’t make any foolish acquisitions, any

improvement in margins or utilization rates should allow retained earnings to

grow equity from 8-10% a year to possibly 15-25%.

Market performance from 2014-2019 for Shibuya reflected by

the Tokyo stock exchange compounded at a poor rate of 3-5% per annum. In an

optimistic scenario, I expect Shibuya to compound 35% annually from USD735M to USD1.7B

in 3-4 years. Consider a pessimistic scenario—3-5% per year or market gains, or

owner’s earnings could drop to USD35-50M, dividends get slashed in half from 2B

yen to 1B (USD18M to USD9M), but there’s still USD277M in cash and decreasing

liabilities, which means at most Shibuya will drop to USD400M .

Sources:

Shibuya annual reports, announcements, financial reports

Capital IQ

No comments:

Post a Comment